GDP, Spain

The European Commission has reduced the previous growth forecasts of the Spanish economy from 2.3% to 1.9% in 2019 and from 1.9% to 1.5% in 2020. The downwardly revised new forecasts are mainly explained by the revision of the historical series of the Spanish National Statistics Institute (INE) and the moderation of the private consumption in the wake of the national and international political uncertainty.

Likewise, the difference in the GDP growth between Spain and the Eurozone is reduced, from 1.1 pp to 0.8 pp in 2019.

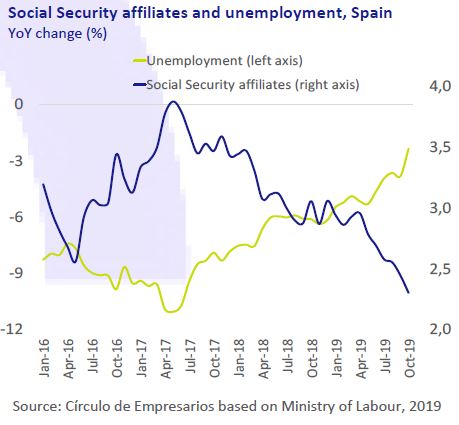

The labour market, Spain

In October, registered unemployment in the Social Security increased by 97,948 people (3.2% month-on-month), reaching a total of 3,163,566 people, and subduing the rate of correction of unemployment to 2.4% yearon- year, compared with 8% average between 2016 and 2018.

Whereas, the number of affiliates increased by 106,542 people (0.6% month-on-month), slowing down job creation to 2.3% year-onyear, which is 1pp below the average for the period between 2016 and 2018 (3.3%).

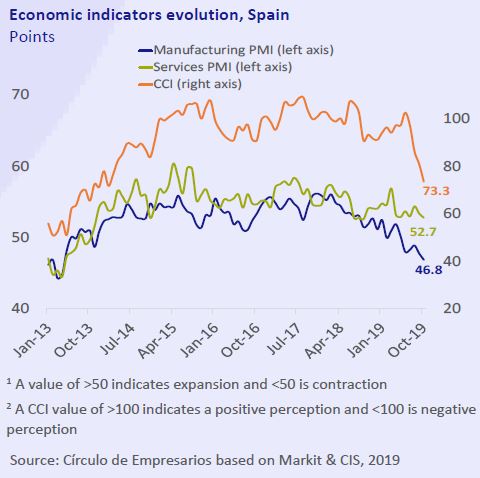

Economic sentiment, Spain

In October, the leading economic indicators confirm the slowdown in Spanish GDP, mainly explained by the political uncertainty, the fragility of the industrial sector, and the lower dynamism of the labour market.

• The manufacturing PMI1 has dropped by 0.9 points to 46.8 points, remaining for the fifth consecutive month in the contraction phase, as a result of dwindling production and fewer new orders.

• The services PMI1 has dropped to 52.7 points, remaining in the expansion phase, as the sales prices were slashed in order to maintain the demand for new orders.

• The Consumer Confidence Index2 has dropped by 7.4 points to 73.3 points, a record low since December 2013 (71 points).

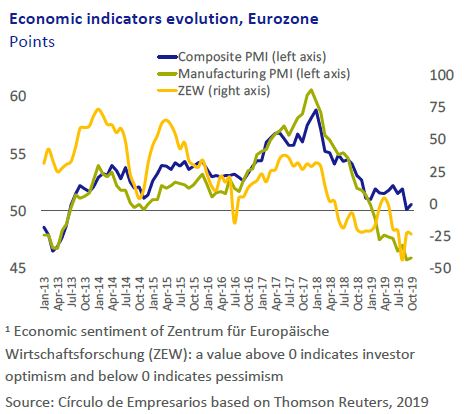

Economic sentiment, Eurozone

In Q3 2019, the GDP of the Eurozone grew by 1.1% year-on-year, which is 0.8pp lower than in 2018 as a whole, in an environment marked by a fragile industrial sector and a weak external sector, especially in Germany.

Among the main economies of this monetary union, Spain and France have maintained their growth rate at 2% and 1.3% year-onyear, respectively, while Italy has continued in a stagnation phase (0.3% year-on-year). In this context, the latest leading economic indicators of October confirm the moderate growth rate:

• The composite PMI, despite a slight increase of 0.5 points to 50.6 points, remains at the record lows of 2013.

• The manufacturing PMI continues in the contraction phase with 45.9 points, its record low since 2012.

• The Eurozone Economic Sentiment Index (ESI) fell to 100.8 points (vs 101.7 in September).

• The ZEW1 index, which measures the economic sentiment of investors in the Eurozone, dropped by 1.1 points to -23.5 points, remains in the contraction phase since

June 2018.

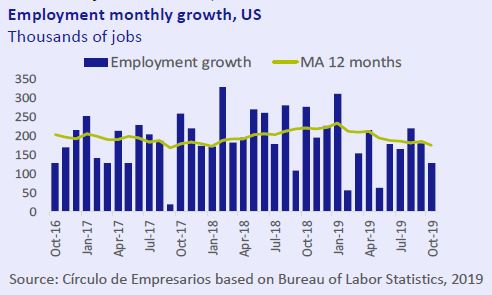

The labour market, USA

In October, the US unemployment rate slightly rose to 3.6%, although it continues at record lows of 1969. Since January, the pace of job creation has moderated in an environment in which wages rise above inflation (2%), and business operating margins are reduced. Specifically, the nonfarm payroll employment increased by 128,000 people, 27% lower than the average of the last 12 months (174,400 jobs/month).

The slowdown in the labour market is mainly concentrated in the industrial sector, where 36,000 jobs were destroyed compared to the average monthly creation of 22,000 jobs in 2018. In contrast, the services sector showed a similar evolution to the previous year with an increase of 157,000 employed people in October (average of 2018 was 163,000 jobs/month).

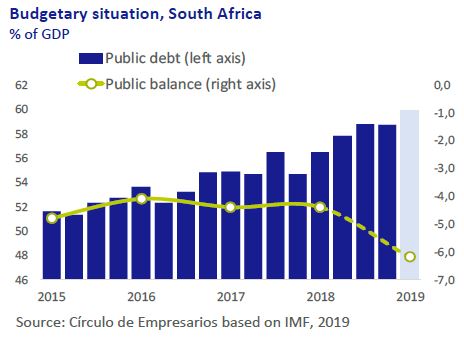

South Africa

Moody’s has revised down the South African debt rating from Baa2 (stable) to Baa3 (negative), placing it one grade above junk bond ratings. The causes of this downgrade are mainly the failure of the Government in the design of its economic policy, the lower growth prospects (0.7% per year in 2019), and the deterioration of its budgetary situation. Specifically, the public deficit is expected to increase to 6.2% of 2019 GDP, compared with 4.4% in 2018, and that the public debt reaches 59.9% of GDP (vs 56.7% in 2018).