Economic slowdown

In August, Spain recorded the third largest economic slowdown among OECD ountries, after Ireland and Slovenia. Specifically, the Composite Leading Indicator (CLI) decreased by 0.22 points to 98.58 and has been below 100 points1 for 12 months now. In turn, the rate at which the Spanish economy is slowing down has doubled that of the Eurozone average (-0.1 points to stand at 98.96).

In this context, Funcas has reduced the annual growth forecasts of the Spanish GDP down to 1.9% in 2019 and 1.5% in 2020 (-0.3 and -0.5 pp, respectively), mainly due to the lower dynamism of domestic demand and the INE’s revision of the historical series of GDP. Currently, the national growth forecasts for this year are in the range between 1.9% and 2.2% per year.

In this scenario, it is forecasted that the public deficit at 2019 year-end will be around 2.5%, 0.5pp higher than the objective sent to the European Commission by the government in power, which means that one more year has been lost in terms of fiscal consolidation.

Tourism sector, Spain

Between January and August, the arrival of international tourists to Spain increased by 1.5% year-on-year, reaching 58.2 million visitors, compared with the stagnation of

the same period of 2018 (-0.02%). By countries, the United Kingdom (21.7% of the total), France (14%) and Germany (13.3%) remain the main tourist sending countries.

As for tourism spending, it increased by 3.2% year-on-year, 0.6 pp more than in the same period of the previous year, reaching €64.1 billion (5.3% of GDP), although the

average spending per tourist experienced a moderate growth of 1.7% year-on-year (€ 1,102 per tourist), which is 0.9 pp lower than that recorded between January and August 2018.

Industry in Spain

In August, for the fifth consecutive month, the Industrial Production Index (IPI) recorded a new year-on-year increase of 1.7%, the third largest of the year. However, this increase is 1.2 pp below the annual average registered between 2015 and 2017, which confirms the lower dynamism of the sector since 2018 due to the weakening of European industry, especially the German industry, and the lower growth in the exports of Spanish goods.

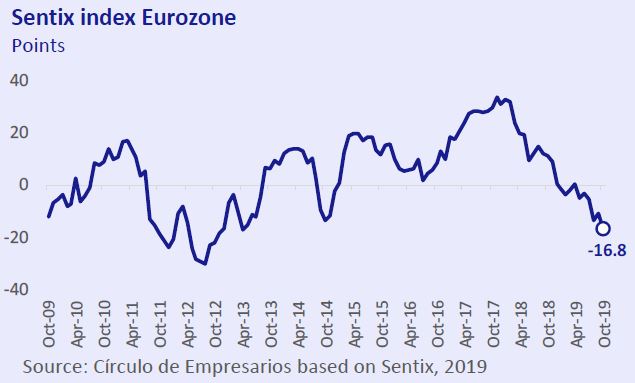

Economic sentiment

The monetary stimulus announced by the ECB and the Fed have failed to mitigate the growing doubts about the future evolution of the European economy.

In October, the Sentix index, which assesses the economic sentiment of investors in the Eurozone, waned by 5.7 points to -16.8 points, its record low since April 2013. The main causes of the deterioration in business confidence are the escalating trade tensions, the slowdown of growth in the Eurozone, especially in Germany, and dwindling corporate profits.

In this context, the IMF warns that the global economy is now in a synchronised slowdown in nearly 90% of the countries, estimating that the cost of the trade war could mean a loss of around $700 billion by 2020 (0.8% of its GDP).

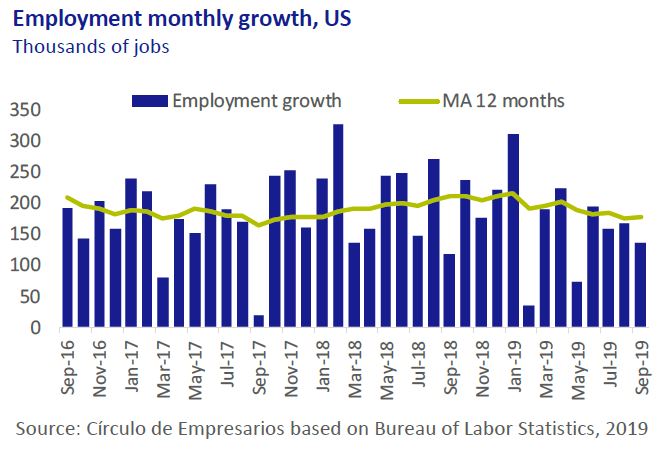

US labour market

In September, the US unemployment rate decreased to 3.5%, reaching a new record low since 1969. In spite of this, its labour market continues to lose dynamism as its

economic growth forecasts worsen. Specifically, the employed population increased by 136,000 people, 19% less than in August, and 23% below the average of the last 12 months (176,700 jobs/month).

By sectors, on the one hand, the 2,000 jobs that were slashed in manufacturing stand out, compared with the average monthly creation of 22,000 jobs in 2018. On the other hand, the services sector increased by 109,000 workers, 33.1% less than in August.

South Korea

Since the beginning of 2019, South Korea has shown signs of an economic slowdown mainly due to the escalating trade tensions with Japan, the global economic slowdown, and the rising geopolitical risks. Specifically, the grim outlook for its industrial and foreign sectors:

• In August, its industrial production fell by 2.9% year-on-year, or a cumulative average drop of 1.3% since January 2019, compared to the average progress recorded of 1.4% since 2015.

• In September, its exports of goods fell by 11.7% year-on-year, which is 11 consecutive months of decline, compared to the progress of a 34.9% increase recorded a year ago.

In this scenario, the South Korean government has announced a series of measures to boost job creation and investment in R&D. This expansive fiscal policy will represent an increase in public spending of 8% against the backdrop of a 40% debt-to-GDP ratio (75% for the OECD) and where its central bank has reduced the official interest rates to 1.5% in August (-25 bp).